WINNSBORO – It was announced in December, 2023, by former Interim Administrator Laura Johnson that Fairfield County had been assessed IRS tax penalties and interest in the amount of $1.4 million and that she had paid most of that amount.

The charges were tied to the Affordable Care Act and the requirement to provide proof of insurance availability to county employees. Instead of seeking the advice of experts and/or state representatives to help the county negotiate or resolve the penalties and fines, Johnson paid them in May and June of 2023 without informing council until December of that year.

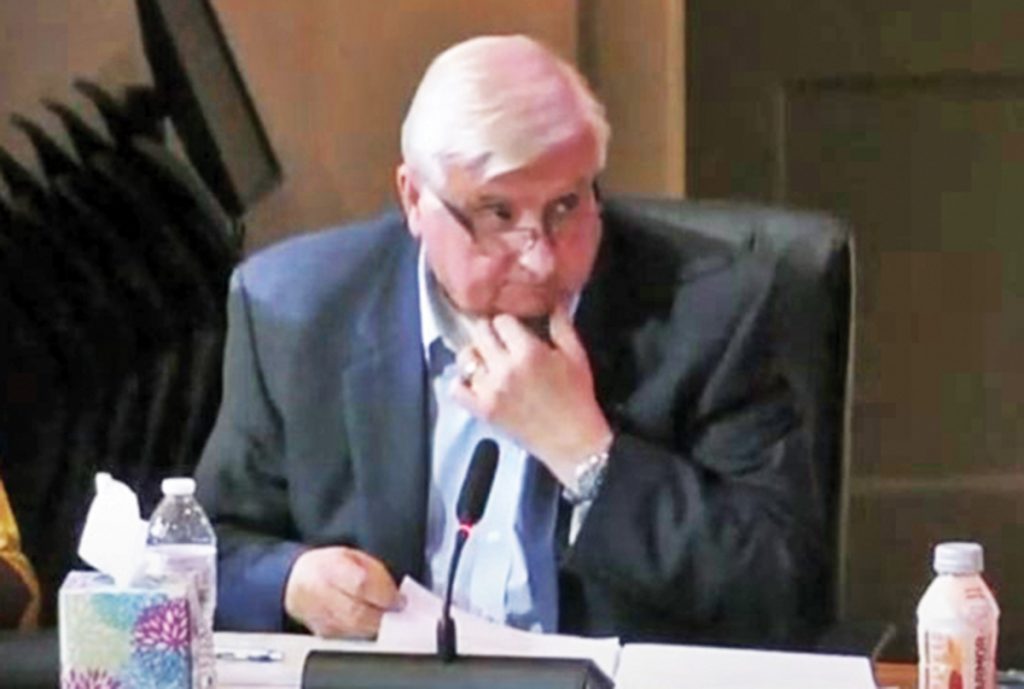

At the recent Feb. 24 meeting of County Council, the county’s most recent Interim Administrator, Clay Killian, announced that, with the help of the county’s auditing firm, Mauldin & Jenkins, penalties and interest in the amount of approximately $800,000 have successfully been appealed so far.

Killian was hired after Johnson’s contract with the county was not renewed in January, 2024.

“The bottom line is that what has been paid will be returned and what has been assessed will be waived,” Killian said.

The county, he said, is looking to get a check for about $800,000 in the next few weeks, while other penalties and interest were waived.

Delivering the positive update, Killian said that one of the things he found is that most of the original fillings were done on time.

“Where the filings were rejected, there were follow up things we needed to do in order to re-submit the filings. That’s where Fairfield County fell down,” Killian said. “Based on the research I’ve done, the county didn’t do the follow up on the rejections.

“Our auditors have a division that does nothing but IRS work,” Killian said. “We engaged them to do the appeals process, and I believe their efforts have been successful up to this point.”

Killian said the following tax penalties were assessed for the years 2017 ($357,740); 2019 ($370,710); 2020 ($386,120); 2021 ($357,000), and 2022 ($247,044).

“Through the appeal process, all fines and assessments are likely to be waived and/or refunded barring any unforeseen situations that may arise,” Killian said.

Final totals will be disclosed upon final appeal approvals/denials.