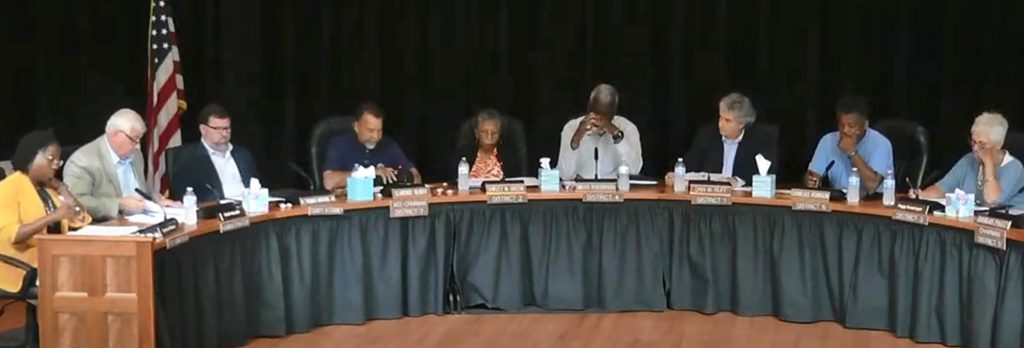

WINNSBORO – Fairfield County Council’s recent discussion of employee salaries behind closed doors likely violated state open meeting laws.

On Monday night, council members convened in executive session for the “receipt of legal advice and discussion of employment and compensation issues involving County employees.”

No action was taken after the secret meeting.

The S.C. Freedom of Information Act (FOIA) allows public bodies to discuss behind closed doors the compensation of “an employee, a student, or a person regulated by a public body or the appointment of a person to a public body.”

However, the law applies to discussion of a specific employee and not all employees, said Jay Bender, an attorney with the S.C. Press Association, of which The Voice is a member.

“Discussion of compensation of more than one individual is not covered and is not permitted for executive session discussion,” Bender said. “Having an illegal meeting about county compensation is not appropriate.”

Ironically, Monday night’s secret session followed an unrelated legal briefing that was conducted publicly.

During the “County Council Time” portion of the agenda, county attorney Tommy Morgan provided extensive legal advice about maintaining county roads and private driveways following questions from Councilwoman Peggy Swearingen.

Monday night’s private briefing also comes two weeks after contentious debate over employee salaries in the recently adopted budget.

On June 24, council members rebuffed a request from Sheriff Will Montgomery to institute a 12% across the board pay increase for all sheriff’s office employees.

Instead, the council’s budget set starting pay at $46,000 with a 3% cost of living increase and 4% raise for deputies only.

A motion to increase starting pay for detention center employees and dispatchers died after failing to receive a second.

“If people understood how little most public employees make, they might have a greater appreciation for the work done for them,” Bender said.

In other business, interim administrator Clay Killian said the county is advancing on resolving its $1.4 million outstanding IRS debt due to previously unfiled tax forms.

Killian said Fairfield recently finalized and filed 2021 forms, and remains hopeful the county’s appeal will reduce or cancel any penalties for that year.

Meantime, work continues on addressing previously unfiled forms from 2017, 2019 and 2020. Killian said those forms should be filed soon.

“The 2019 [reports] have been assessed and paid, but we think we’re going to get a good bit of [the penalties] back,” Killian said. “The 2020 [forms] have been partially paid, but we still need to get all the reports in, which we hope will happen in the next couple of weeks.”

Killian said the county has paid $780,000 of an estimated $1.4 million in IRS penalties.

The county accrued the debt from unpaid penalties and interest stemming from late, incorrect and unfiled healthcare tax forms, as well as financial reports, dating back to 2017. Then interim administrator Laura Johnson paid hundreds of thousands of dollars of the penalties months prior to addressing those fines and payments with council. Johnson’s contract was not renewed in January, 2024.

Killian said the county’s auditing firm continues to negotiate with the IRS to cancel as much debt as possible.

Fairfield is paying $40,000 to Mauldin Camp; Jenkins, the county’s auditing firm, to assist the county and work with the IRS.

“Hopefully we can get those [fines] turned away even before we get them assessed,” he said. “We’re hopeful and think things are moving in the right direction.”

Council members also approved first reading of an ordinance establishing the county’s millage rate.

Documentation included with the agenda doesn’t state the specific millage rates that make up Fairfield’s overall tax structure. However, Killian said the budget does not increase taxes.

Killian also noted most S.C. counties adopt the millage rate via resolution whereas Fairfield adopts an ordinance to allow for public comment.

Killian’s comments came following criticisms aired during public input, where council critic Randy Bright scolded council members for not including millage details in the ordinance.

“Putting the millage on today’s agenda is another affront to every single resident of this county,” Bright said. “In that ordinance, there are no details. There are no details despite the fact that S.C. laws allow you to put details in the first reading.”