Councilman Donald Brock

Councilman Rich McKenrick

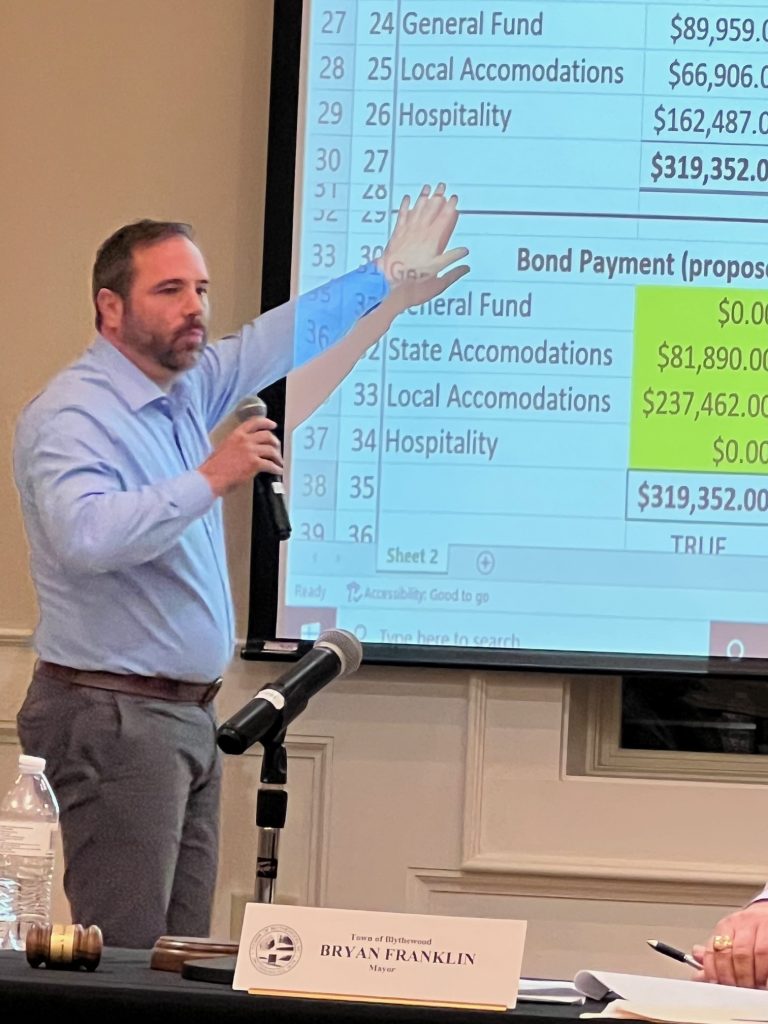

BLYTHEWOOD – During a special called meeting of Town Council on Monday, Dec. 19, Councilmen Donald Brock and Rich McKenrick, as members of the subcommittee of the newly appointed state accommodations tax advisory committee, presented what they called a landmark recommendation for the overhaul of how council administers hundreds of thousands of dollars each year of state and local accommodations tax (SAT and LAT) and hospitality tax (HTAX) revenue.

“Over the last two budget cycles, this council has discussed, debated and, frankly, failed to address the ballooning allocations of our accommodations and hospitality awards,” Brock said.

He also alluded to the fact that some of those allocations have not met the legal requirements of Title 6 of the SC Code of Laws, such awarding funds to for-profit entities.

Last summer, council charged the two with proposing a new policy for the allocation of revenue the town derives from SAT, LAT and HTAX.

Presenting their proposed policy, Brock said it, “would simplify payments to the Blythewood Facilities Corp (BFC), allocate significant resources to [the Town’s] capital assets, capital projects and capital improvements, and still allow the Town to sponsor and support local historical, cultural and recreational facilities and events.” (Note: In a complex arrangement, the BFC financed the construction of the Manor in 2010 through a special kind of revenue bond, and the Town makes payments to the BFC totaling about $319K each year to buy back a portion of the assets that secured the BFC financing.)

Both Brock and McKenrick maintain that the goal of the recommendation is to align the town government with what they believe is council’s overall mission: to enhance the lives of the town’s citizens while bringing the government into compliance with Title 6 of the SC Code of Laws, which, among other things, specifies which types of events qualify for SAT, LAT and HTAX awards and which do not.

The first two pages of the four-page proposed policy reiterate Title 6 of the SC Code of laws that apply to SAT, LAT and HTAX allocations. The second two pages outline the rules for the subcommittee’s recommendations, as follows:

- Expenditures must strictly adhere to the permitted uses outlined by Title 6 – Local Government.

- All expenditures must be approved by the Town Administrator prior to disbursement of funds.

- First year events are funded at a maximum of $7,500 of eligible expenses in the first fiscal year.

- Subsequent year events are funded at a maximum of $5,000 of eligible expenses per fiscal year.

- Organizations are capped at $15,000 in the first fiscal year of implementation and $10,000 in all subsequent years.

- Ticketed and private events (to include for-profit and religious organizations) do not qualify for SAT, LAT or HTAX funding.

According to the recommendations, an excel formula-driven document will be used by the Town to determine the uses and allocations within SAT, LAT and HTAX. As the revenue changes, the formula will float as it provides not only for awards for events but also for payments to the BFC and sets aside funds for capital assets, capital projects and capital improvements.

“These numbers [for event allocations] are the worst it will get,” McKenrick said of the recommendation for reduced funding for most events currently funded. “As more businesses open and more people stay and eat, the more funds will be available beyond this year. Year after year organizations apply for and get money for high quality events. The problem is we can’t purchase infrastructure to support them.”

As an example, he said some Doko Park events don’t have enough parking space.

“The action we took following executive session tonight [to purchase land], will solve that parking problem,” he said. But a review of the Town’s current finances shows the town can’t afford such infrastructure. The recommendation is to redirect some of the current allocations for events to capital assets, projects and improvements which would pay for needed infrastructure and other things.

“The allocation numbers will increase over time,” McKenrick said.

Brock agreed, saying the town’s $319,000 financial obligation to the BFC will end in about 10 years, freeing up that money.

“And that’s the tip of the iceberg,” he said. “The industrial complex will add more to the town’s coffers.”

Under the committee’s recommendations, most SAT, LAT and HTAX funded events will receive reduced funding or not qualify at all for the restricted SAT, LAT and HTAX funds. However, Brock and McKenrick suggested that some of those events could be funded from the general fund if the council chooses to do so.

Council voted unanimously to defer a vote on the recommended policy until council’s Jan. 6 meeting at the Manor.

The complete policy proposal can be viewed here: